Entri yang Diunggulkan

- Get link

- X

- Other Apps

Whether you get health insurance through your job directly from an insurance company or through the Healthcaregov marketplace you may have the option to choose a high deductible health plan HDHP. Therefore if your insurance from work has a high deductible but the company is not offering an HSA its likely that the plan doesnt qualify as an HDHP.

Health Insurance Deductible How Do Deductibles Work Mint

Health Insurance Deductible How Do Deductibles Work Mint

With such a high annual deductible I will be paying for ALL my health care out of pocket and so will my husband and yet I am forced to pay high monthly premiums that do us no good.

My health insurance deductible is too high. If your premiums are made through a payroll deduction plan they are likely made with pre-tax dollars so you would not be allowed to claim a year-end tax deduction. However your expenses when you use your insurance are often higher than that of a person with a low-deductible plan. If you cant afford your deductible your options for dealing with it depend on whether you owe your deductible right now or whether youre preparing in advance.

For 2019 the IRS defines a high deductible health plan as any plan with a deductible of at least 1350 for an individual or 2700 for a family. Heres a simple example to show how a deductible works. However you may still be able.

A high deductible health plan HDHP has lower monthly premiums and a higher deductible than other health insurance plans. A high deductible plan is also good for individuals who dont want a high monthly payment and dont go to the doctor often. If you have a high-deductible health plan your deductible may be as high as your out-of-pocket maximum making you eligible for a health.

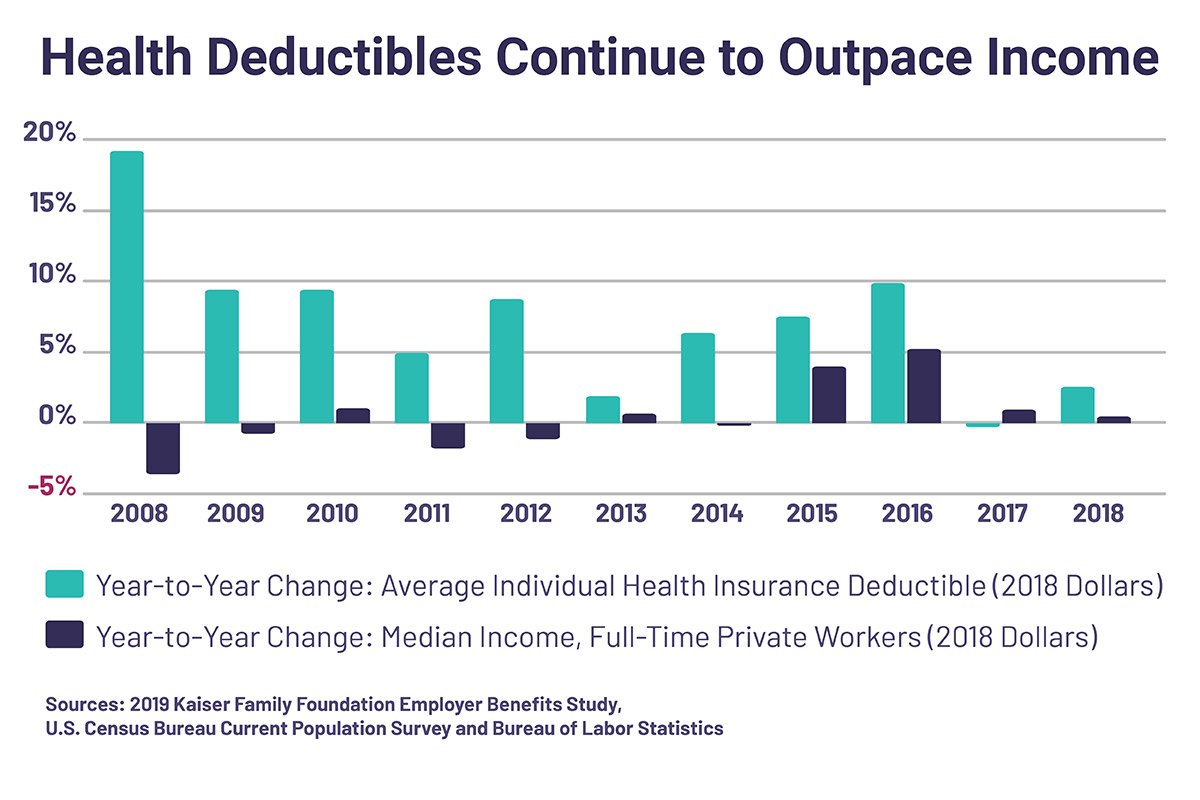

We discovered that if someone chose a 1000 deductible instead of a 100 deductible the. I am in my early 40s and only see my PCP twice a year for blood work and prescription renewals. One alternative to sky-high monthly health insurance premiums for many Americans is opting for a high-deductible plan instead.

A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for certain medical expenses with money free from federal taxes. In 2016 3365 of the 4058 plans 83 on the federal exchange had deductibles greater than 1300. Say you have a high deductible plan but your monthly payment is low.

A deductible is the amount of money you pay before your insurance provider begins to pay. But the average deductible for a Silver Plan this year is 3572 for an individual and 7474 for a family according to the health insurance data website HealthPocket. The Kaiser Family Foundations 2020 Employer Health Benefits Survey showed that on average premiums increased 4 over the past year for both individual and family coverage.

People also opt for high-deductible plans to save money. People who are relatively young and healthy often decide to opt into a less expensive policy with a high health insurance deductible that just covers the bare minimum. High deductibles usually come with lower monthly premiums.

Musgrave and I began by looking at health insurance prices. No matter how much your deductible is if you dont have that much in savings and youre living paycheck to paycheck it can feel like your deductible is too high. Its possible even though your health insurance has a high deductible you are still not eligible to contribute to an HSA.

Lets say your health insurance plan has a 1000 deductible. Rational reasons for a high deductible. However a high deductible plan can sometimes work in your favor financially.

For 2020 the Internal Revenue Service IRS defines an HDHP as one with a deductible of 1400 or. There are many such plans available for critical illness and those vary widely by state. A person with a.

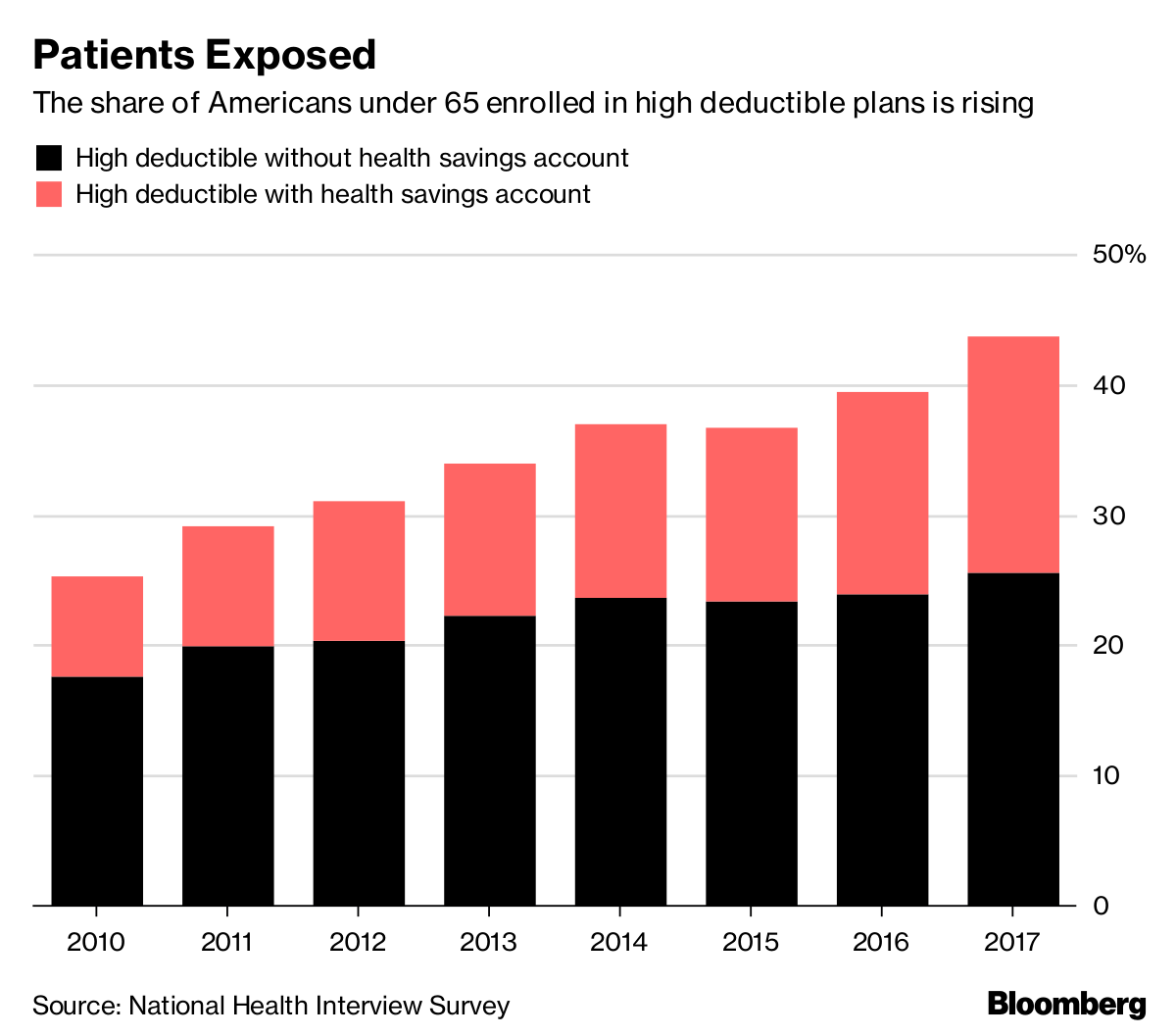

At the same time a tool that could soften the blowthe Health Savings Account HSA which allows people to pay many of their health care costs with tax-deductible dollarsis not available to most Americans with high-deductible plans. And in place of a high deductible health insurance plan consider a critical illness plan that will pay a large lump-sum if you have a heart attack stroke cancer or something similar. Ask your insurance agent for advice.

You get injured mountain. Those plans come with lower monthly premiums but their elevated. My employer only offers a high deductible health plan.

A deductible is the amount you must pay out of pocket for health care before your insurance coverage kicks inan HDHP sets this number higher than typical health. If you feel like your employer health insurance is too expensive it could be because premiums and deductibles for group health insurance policies are on the rise.

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Sky High Deductibles Broke The U S Health Insurance System Bloomberg

Sky High Deductibles Broke The U S Health Insurance System Bloomberg

Too High A Price Out Of Pocket Health Care Costs In The United States Commonwealth Fund

Too High A Price Out Of Pocket Health Care Costs In The United States Commonwealth Fund

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

What You Need To Know About High Deductible Health Plans

What You Need To Know About High Deductible Health Plans

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Dilemma Over Deductibles Costs Crippling Middle Class

Dilemma Over Deductibles Costs Crippling Middle Class

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Health Insurance Costs Crushing Many People Who Don T Get Federal Subsidies Kaiser Health News

Health Insurance Costs Crushing Many People Who Don T Get Federal Subsidies Kaiser Health News

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

Rising Health Insurance Deductibles Fuel Middle Class Anger And Resentment Los Angeles Times

What To Do When You Can T Pay Your Health Insurance Deductible

What To Do When You Can T Pay Your Health Insurance Deductible

Dilemma Over Deductibles Costs Crippling Middle Class

Dilemma Over Deductibles Costs Crippling Middle Class

Sky High Deductibles Broke The U S Health Insurance System Bloomberg

Sky High Deductibles Broke The U S Health Insurance System Bloomberg

Comments

Post a Comment