Entri yang Diunggulkan

- Get link

- X

- Other Apps

With expiring patents and high costs of research and development acquiring or being acquired may sometimes be the best or only option to bring in adequate revenue. Organon was the result of a merger between Diosynth and Organon in the year 2004.

How Can Pharma Companies Adapt To The Current M A Environment

How Can Pharma Companies Adapt To The Current M A Environment

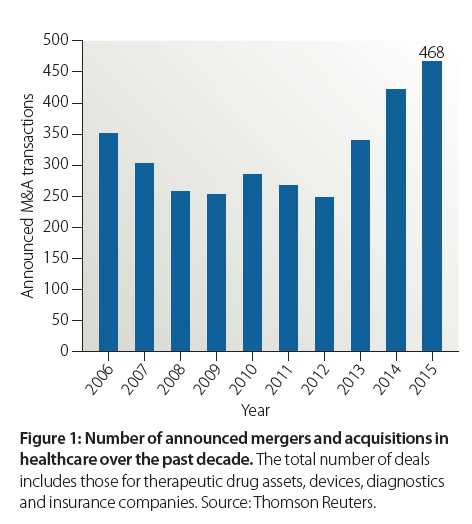

Over the last few decades waves of MA have led to significant consolidation.

Pharmaceutical companies mergers and acquisitions. Recently big pharma has once again turned to megadeals to address pipeline therapeutic and geographic expansion needs. The first week of January was merely the beginning. July 28 2020 by Samantha McGrail.

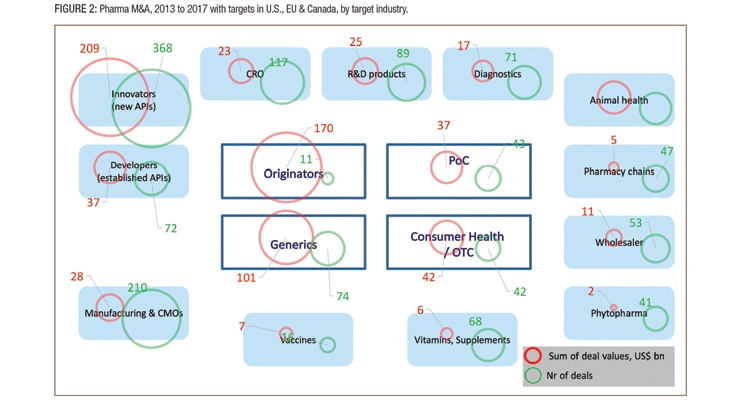

Pharma industry is one of the leading industries in the number of MA and the size of investments for such transitions. In terms of innovation large pharmaceutical companies often purchase small companies with drugs in late stage clinical trials. Boston Scientific Abbott Laboratories.

Some of biopharmas biggest companies announced acquisitions in March and April. Mergers and Acquisitions Due Diligence. Last year Takeda Pharmaceuticals acquired the Irish pharmaceutical manufacturer Shire for 603 billion dollar making it the largest takeover of a Japanese company abroad.

A recent PwC insights analysis found that the pharmaceutical merger and acquisition activity saw a notable decline in the first half of 2020 but the potential for consolidation in specific sub-sectors remains high. Merger formed Novartis 290. After all pharmaceutical companies need to do what is necessary to meet the needs of their investors.

The largest among them are Alkermes ALKS Galapagos GLPG and Ironwood Pharmaceuticals. In the first week of the year two multi-billion-dollar deals were announced. Mergers and acquisitions MA in pharmaceuticals got off to a roaring start in 2019.

49 rows Merger formed AstraZeneca 304. Mergers and acquisitions play a crucial role in the growth strategies for most pharmaceutical companies. Pharmaceutical Mergers Acquisitions Down in First Half of 2020.

In addition to increasing shareholder value management pursues mergers and acquisitions for a variety of reasons including innovation synergy and portfolio realignment. Amgen Companies mergers and acquisitions Pfizer Pharmaceutical Sanofi Takeda. This big trend in pharma mergers and acquisitions doesnt seem to be slowing down.

Number of IPOs for neurology companies 2006-2018. In order to close the deal Takeda had to improve its offer four times. Aerpio Pharmaceuticals Inc a biopharmaceutical company focused on developing compounds that activate Tie2 and Aadi Bioscience Inc a privately-held biopharmaceutical company focusing on precision therapies for genetically-defined cancers with alterations in mTOR pathway genes announced their entry into a definitive merger agreement.

Total number of pharma and biotech merger and acquisition deals 2015-2020 Market cap of select pharma companies with strong pipeline 2017 US. A due diligence process thats too high-level or superficial is often to blame. In June 2014 Merck acquired Cubist Pharmaceuticals for 84 billion that was the result of a merger between Idenix Pharmaceuticals and Trius Therapeutics.

The value for MA in the pharmaceutical sector was 221 billion in the first half of the year 2015. Together the deals totaled 82 billion and one of the two landed in the top 10 biggest pharmaceutical MAs of all time. A report has found that the global pharmaceutical industry saw more than 400 mergers and acquisitions MA in the gene therapy immuno-oncology microbiome and orphan drugs therapeutic categories from 2014 to the first half H1 of 2019.

The acquisition is expected to be completed in the first half of 2019. A number of small and midsize pharmaceutical companies are attractive takeout candidates Divan said. Total MA deal values of biopharma therapeutics and platforms diagnostics and medtech companies dropped 26 percent to 1909 billion after steadily rising for three years running while the total number of acquisitions acquisition options and reverse mergers continued to rise reaching 384 completed or active deals up 10 percent from 2019.

Many companies move forward on pharmaceutical deals without a clear picture of their risks. It is easy to notice that Mergers and Acquisitions MA have become a frequent occurrence in the Pharmaceutical industry especially during the previous decades. And when a deal doesnt deliver value the real causes are often strategic cultural or technical.

What Drives Mergers Acquisitions In The Pharma Industry Contract Pharma

What Drives Mergers Acquisitions In The Pharma Industry Contract Pharma

Major Mergers And Acquisitions Deals In Pharmaceutical Industry Since Download Table

Major Mergers And Acquisitions Deals In Pharmaceutical Industry Since Download Table

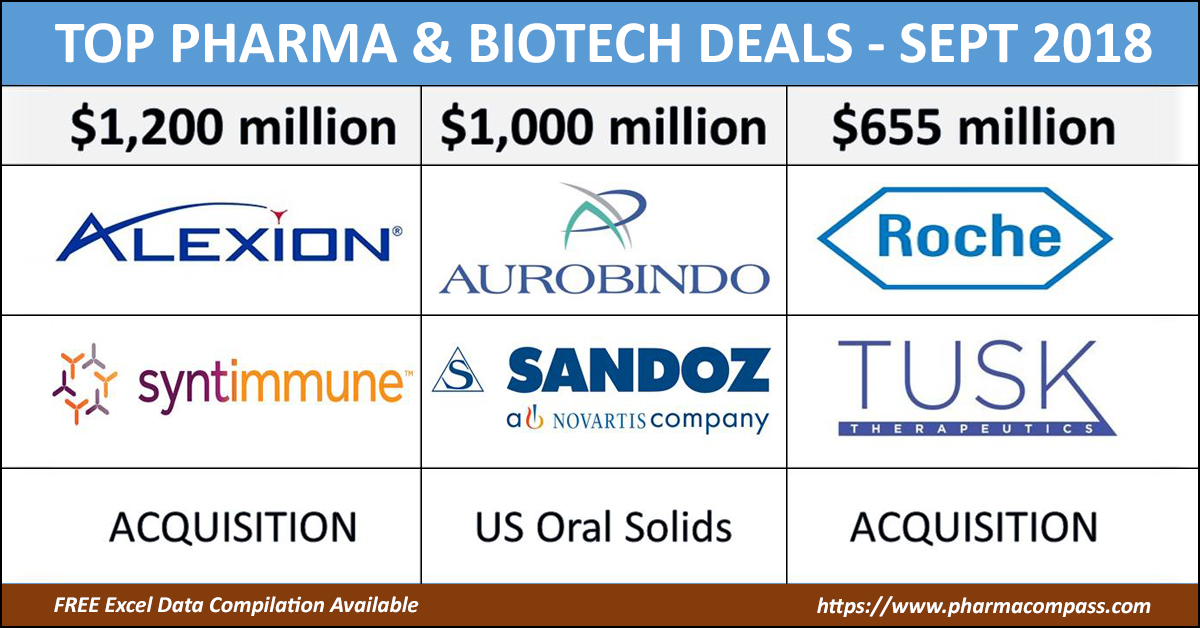

Top Pharma Biotech Deals Investments M As In September 2018 Pharma Excipients

Top Pharma Biotech Deals Investments M As In September 2018 Pharma Excipients

13 Largest M A Deals Of All Times Top Acquisition Examples

13 Largest M A Deals Of All Times Top Acquisition Examples

The Biggest Pharma Merger And Acquisition Deals Of 2019

The Biggest Pharma Merger And Acquisition Deals Of 2019

Mergers Acquisitions Pharma Industry

Mergers Acquisitions Pharma Industry

Effect Of Mergers And Acquisitions On Drug Discovery Perspective From A Case Study Of A Japanese Pharmaceutical Company Sciencedirect

Effect Of Mergers And Acquisitions On Drug Discovery Perspective From A Case Study Of A Japanese Pharmaceutical Company Sciencedirect

Mergers And Acquisitions Activity In Bio Pharma Industry Remains High Despite Covid 19 Globaldata

Mergers And Acquisitions Activity In Bio Pharma Industry Remains High Despite Covid 19 Globaldata

13 Largest M A Deals Of All Times Top Acquisition Examples

13 Largest M A Deals Of All Times Top Acquisition Examples

Mergers And Acquisitions In The Healthcare Industry Article Middle East Kearney

Mergers And Acquisitions For Big Pharma Pharma World

Mergers And Acquisitions For Big Pharma Pharma World

Trends In Pharmaceutical Mergers And Acquisitions

Trends In Pharmaceutical Mergers And Acquisitions

Comments

Post a Comment