Entri yang Diunggulkan

- Get link

- X

- Other Apps

Learn vocabulary terms and more with flashcards games and other study tools. Calculate the deduction for group health insurance.

Https Www Allenisd Org Cms Lib Tx01001197 Centricity Domain 2533 Worksheet 202 4 20and2 6 Pdf

State income tax rate is 15 percent of taxable income.

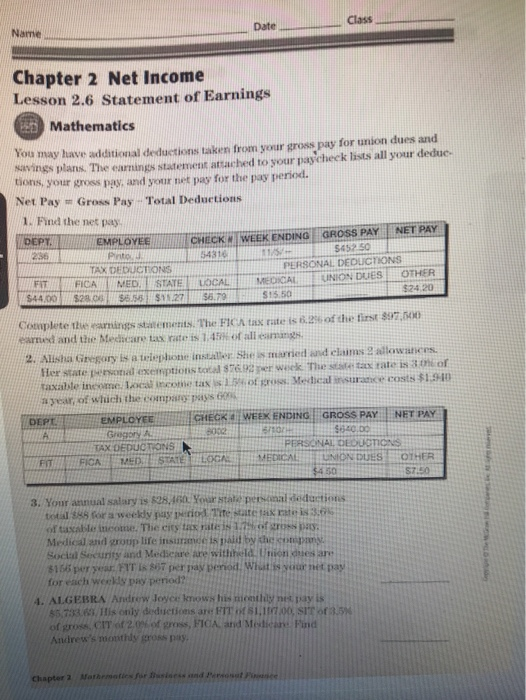

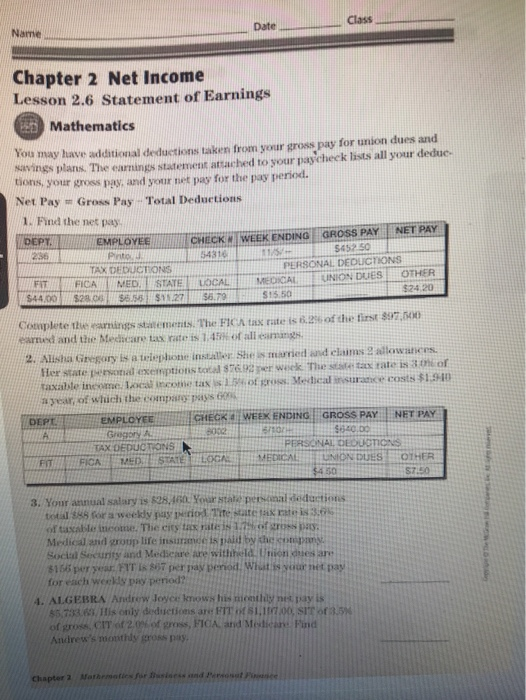

Chapter 2 net income lesson 2.5 group health insurance answers. She has family medical coverage through Ozarks group medical plan. Employees Share Annual Amount X Employees Percent Deduction per Pay Period Total Annual Amount Paid by Employee Number of Pay Periods per Year. This is very similar to Example 1 in the textbook page.

Section 2-5 Group Health Insurance Group Insurance Lower cost than individual insurance. Alyssa Rodriguez is employed as a social worker. On a large construction project the price of sheet lumber per square foot is 30 and spraying the lumber with an anti-termite agent is 40 per square yard.

Nadine McClure is a carpenter for Ozark Construction Company. 23 G RADUATED S TATE I NCOME T AX Used in some states. Finish up with Lessons 21-24 Tuesday.

1 The financial statements of a business entity. Start studying Chapter 2. Group Health Insurance Businesses often pay part of the cost of the insurance and the employee pays the remaining amount.

Her employer pays 55 of the cost. O O o to o o o CD o 69 00 CD o o O z CD o cn O cn. A Include the balance sheet income statement and income tax return.

2 Lessons from 3 Years of Experience 1. The company pays 75 of the cost. Chapter 1 Gross Income 2 Net Income 3 Recordkeeping 4 Checking Accounts 5 Savings Accounts 6 Cash Purchases 7 Charge Accounts and Credit Cards 8 Loans 9 Vehicle Transportation 10 Housing Costs 11 Insurance 12 Investments All in the same weekend you graduated from high school and you landed a job.

Further unless and until additional guidance provides otherwise an S corporation with a 2-percent shareholder-employee healthcare arrangement will not be required to file IRS Form 8928 regarding failures to satisfy requirements for group health plans under chapter 100 of the Code including the market reforms solely as a result of having a. O Employees Share Annual Amount x Employees Percent x The employees amount is usually deducted each pay period. Find the taxable wages and the annual tax withheld.

And how the newly enrolled are using their insurance. Rate on low incomes is usually 1-3 and high incomes can be as much as 20. 2-5 Group Health Insurance.

139 READ and do 1-9 ODD 13-23 ODD 25 SOLUTIONS PART 12 Lesson 26 Statement of Earnings - Pg. Chapter 02Basic Financial Statements CHAPTER 2 NAME 10-MINUTE QUIZ A SECTION Indicate the best answer for each question in the space provided. The workshop opened with a presentation by Karen Pollitz senior fellow at the Henry J.

Lesson 25 Group Health Insurance. She has medical coverage through the group medical plan that her company provides for its employees. Involves a different tax rate for each level of income.

O Deduction per Pay Period. 9292015 41749 PM. Selecting a Banking Partner.

Tax rate increases as income increases. Lower cost than individual insurance purchase Deduction Formula. 2-6 Statement of.

Rounding can cause your answer to be a penny or two off from the answers below. S ince businesses often pay part of the cost of insurance and the employee pays the other part your first step will be to determine the percent that the. Understanding Your Take Home Pay.

Often offered by businesses to their employee. Kaiser Family Foundation on the lessons learned about the challenges in signing up different population groups. Perceptions of the cost and affordability of insurance.

Annual gross pay is 28000. 23 SOLUTIONS PART 10 Lesson 24 Social Security and Medicare Taxes - Pg. Includes tutorials practice quizzes flash cards and many more resources to help with your academic success.

B Provide information about the profitability and financial position of the. Individual health insurance is written on a nonparticipating basis whereas group health insurance is generally written on a participating basis. Net Income NOTES 25 Group Health Insurance x Group Insurance costs less to purchase than individual insurance.

142 READ and do 1-9 ODD 15-21 ODD 26 SOLUTIONS PART 13 Chapter 2 Review - Pg. 120 Chapter 2 Net Income CONCEPT CHECK Check your answers at the end of the chapter. Pages 139-141 Examview password.

137 READ and do 1-21 ODD 24 SOLUTIONS PART 11 Lesson 25 Group Health Insurance - Pg. WB Page 25 2-5. 25 Group Health Insurancenotebook 2 September 16 2016 Example 1.

How much is the annual premium. Annual gross pay is 34300. 929 Prepare your reference sheet for tomorrows quiz.

The annual cost of Nadines family membership is 9800. Now you can afford to find a place of. Kim Choi pays 11580 per month for group medical insurance.

Tax Withheld Per Pay Period Annual Tax Withheld Number of Pay Periods Louises annual salary is 34500. Net Income Chapter 25 Group Health Insurance Objectives. Individual health insurance is written on a basis whereas group health insurance is generally written on a basis.

Saving for a Rainy Day. Remember to refer to the Personal Exemptions table on page 119 1. Lower cost than individual insurance.

Total deductions 14936.

Class Date Chapter 2 Net Income Lesson 2 6 State Chegg Com

Class Date Chapter 2 Net Income Lesson 2 6 State Chegg Com

Class Date Chapter 2 Net Income Lesson 2 6 State Chegg Com

Class Date Chapter 2 Net Income Lesson 2 6 State Chegg Com

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Https Wildasinsclass Weebly Com Uploads 2 5 9 7 25971073 Chapter 2 Net Income Assignment Sheet And Handouts Pdf

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Federal Income Tax Fit Pdf Free Download

Federal Income Tax Fit Pdf Free Download

Http Www Pasd Com Userfiles Servers Server 435325 File 2 5 20worksheet Pdf

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income Lesson 25 Group Health Insurance Answers Picshealth

Chapter 2 Net Income 2 1 Federal Income Tax Fit Federal Income Tax Is Money Withheld By Employers Tax Table On Pg 790 Carlas Gross Pay For This Week Course Hero

Chapter 2 Net Income 2 1 Federal Income Tax Fit Federal Income Tax Is Money Withheld By Employers Tax Table On Pg 790 Carlas Gross Pay For This Week Course Hero

Comments

Post a Comment