Entri yang Diunggulkan

- Get link

- X

- Other Apps

Cost sharing is the portion of health care services that an individual pays out of their own pocket. What is Health Sharing Health care sharing ministries provide a way to pay for health care costs that is different than traditional health insurance.

How Does Medical Cost Sharing Work Oneshare Health Blog

How Does Medical Cost Sharing Work Oneshare Health Blog

Cost sharing is the concept of sharing medical costs some of which you pay out of pocket and some which your health insurance company covers.

How does medical cost sharing work. As a member of a health sharing ministry you pay a Monthly Share Amount. Our office is open and we are offering our popular estate planning seminars virtually. Cost sharing means that you will not generally be paying for all of your covered medical expenses on your own and that your individual health insurance plan may help you with these incurred expenses.

After your personal responsibility is met and the medical necessity verified by Medical Cost Sharing staff your payment which is shared by other members is sent directly to the medical professional you used. Additionally all meetings will be conducted through video chat and telephone calls so that you can get your affairs in order now safely. This is done electronically.

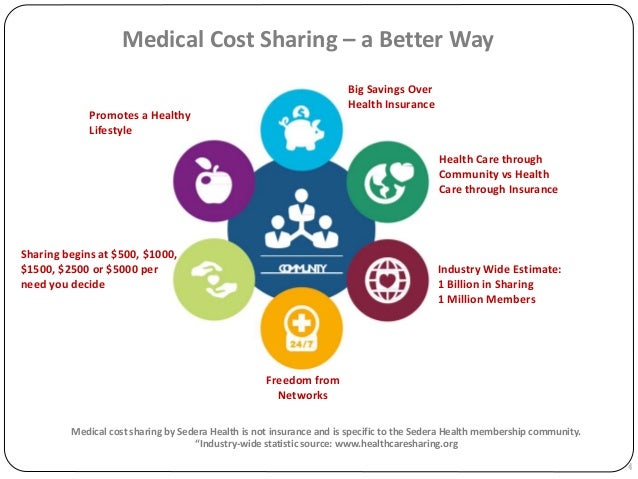

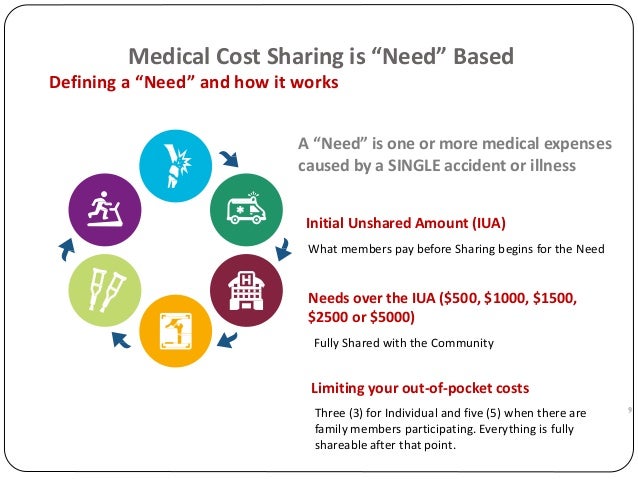

Unlike traditional health insurance plans there is no network such as Blue Cross Blue Shield. For any month if he does not have over 1100 in medical bills he pays only his expenses and is allowed to keep the rest of his income. Medical cost-sharing is used to describe the collective effort between Members of a Health Care Sharing Ministry HCSM to pay Eligible medical bills.

We recommend all members save at least 100000 to cover any out-of-pocket expenses. The medical provider will send the bill to the PHCSMultiplan network contracted with the Medical Cost Sharing plan. A Medi-Cal share of cost for long-term Medi-Cal is similar to a copay that you find in your own health insurance.

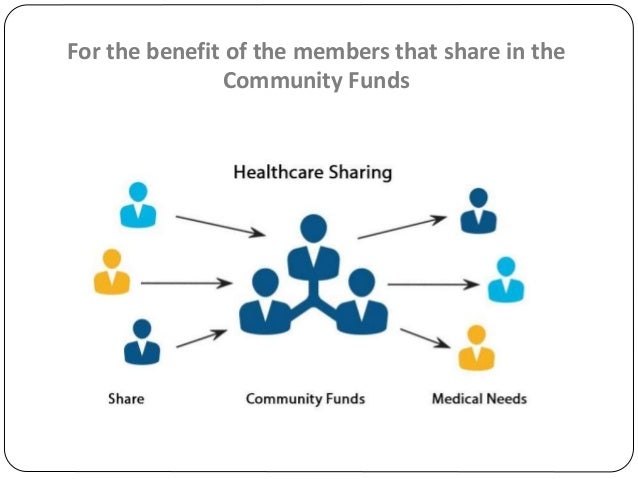

Healthcare system is set up to help low- and middle-income consumers have more affordable access to medical care. As a Member of OneShare Health each month your Monthly Contribution goes into a giant pool of financial resources to be used in behalf of other Members Eligible medical bills and vice versa. Lets do the math 8320 3500 4820 x 30 1446.

This will be in your name. Their team of experts will then negotiate the lowest cost on your behalf and validate the cost with the provider. But even with good health coverage individuals usually have to pay a portion of their health care costs.

Cost-sharing or co-pay requirements. Cost-sharing requires a recipient to pay a set amount or percentage of each health care service received while share of cost requires recipients to take full responsibility for health care expenses up to a predetermined amount. Health insurance covers many of the out-of-pocket expenses a person may owe for medical care.

Each medical cost-sharing request is analyzed and marked as Eligible for sharing Follow-up Required or Ineligible for sharing. If Paula and Sammy have additional medical expenses and spend 4100 on cost-sharing charges during the year the family will reach their health plans 12000 out-of-pocket limit and will pay no cost sharing for the rest of the year. You can visit any provider of your choice and use your membership card when they ask for insurance.

In this case once you pay 3500 for covered medical services out of pocket your plan will cover 70 of the remaining charges until you reach your out-of-pocket maximum 6000 in this scenario. A proven alternative to the high cost of health insurance medical cost sharing or Healthshares are becoming a popular alternative for many people across the. Cost-sharing in the US.

Share of cost Medi-Cal is typically used by beneficiaries in one of three. This monthly share is then used to pay for the health care needs of other members. If Eligible for Sharing UHSM calculates the sharing costs notes member ledgers and authorizes escrow disbursement so that members can pay for one anothers medical needs.

The way his share of cost is determined is by subtracting the maintenance needs allowance from his monthly income which comes to a cost share of 1100 1700 - 600 1100. Medical cost-sharing ministries are a group of people who band together to help each other pay for medical expenses. At that point the plan will cover 100 of covered services until the plan year ends.

The idea was that insurers would subsidize consumers healthcare costs and in turn the federal government would reimburse insurance companies for the cost of these cost-sharing subsidies. Find out more about how medical cost-sharing programs work As an affordable way to pay for healthcare a medical cost-sharing program equips and supports individuals and families in making wise decisions about healthcare treatments and spending while providing a community that helps to share costs.

Medical Cost Sharing Mint Benefits

Medical Cost Sharing Mint Benefits

How Member To Member Medical Cost Sharing Programs Work

How Member To Member Medical Cost Sharing Programs Work

Cost Sharing Health Insurance 101 Blue Cross Nc

Cost Sharing Health Insurance 101 Blue Cross Nc

Medical Cost Sharing Demystified 6 Facts To Know About Medical Cost Sharing Sedera

Medical Cost Sharing Demystified 6 Facts To Know About Medical Cost Sharing Sedera

Benefitgeek Health Insurance Companies Medical Insurance Health Insurance

Benefitgeek Health Insurance Companies Medical Insurance Health Insurance

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Deductibles Health Insurance Plans Health Insurance Work Health

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Deductibles Health Insurance Plans Health Insurance Work Health

Medical Cost Sharing Demystified 6 Facts To Know About Medical Cost Sharing Sedera

Medical Cost Sharing Demystified 6 Facts To Know About Medical Cost Sharing Sedera

Small Business Health Insurance Copayment

Small Business Health Insurance Copayment

How Does Cost Sharing Work Healthnetwork Blog Healthnetwork Blog

How Does Cost Sharing Work Healthnetwork Blog Healthnetwork Blog

Comments

Post a Comment