Entri yang Diunggulkan

- Get link

- X

- Other Apps

This week the Justice Department blessed a 69 billion merger between pharmacy chain CVS and insurance giant Aetna. CVS creates new health-care giant as 69 billion merger with Aetna officially closes CVS Health and Aetna have closed their 69 billion merger.

Cvs Health And Aetna Merger Boomer Benefits

Cvs Health And Aetna Merger Boomer Benefits

The combined company would reap an estimated 240 billion in annual revenue.

Cvs and aetna merger. A double-edged sword when it comes to options. The combined company will connect consumers with the powerful health resources of CVS Health in communities across the country and Aetnas network of providers to help remove barriers to high quality care and build lasting relationships with consumers making it easier for consumers to access the information resources and services. As a result of the merger of Aetna with a subsidiary of CVS Health the Merger each Aetna common share has been automatically cancelled and converted into the right to receive the Merger Consideration consisting of the Stock Consideration of 08378 of a share of CVS Health common stock and the Cash Consideration of 14500 without interest.

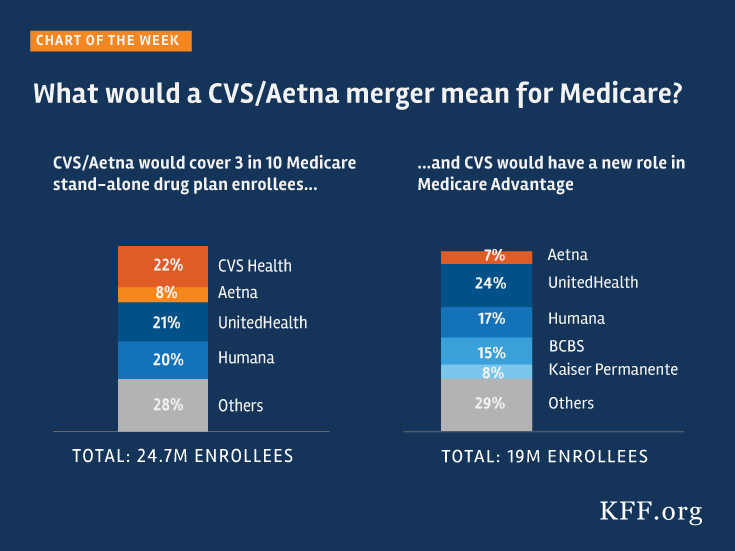

The merger has yet to face regulatory scrutiny but if the merger passes CVS-Aetna will become a major game-changer in healthcare procurement. CVS has suffered declining profits as consumers turn to online suppliers for drugs. In horizontal mergers two competitors combine and CVS-Aetna are significant competitors in numerous Medicare Part D geographic markets and also with respect to pharmaceutical benefit management PBM services.

A landmark health care merger is inches away from the finish line. Both the CVS-Aetna and Cigna-Express mergers would alter the health insurance industry to a point where three payer-PBM organizations would have significant control over the healthcare marketplace. Consumers might find they have fewer choices about where they can get.

Department of Justice has been taking a closer look at so-called. Although CVS and Aetnas planned merger does not directly consolidate the health insurance or pharmaceutical industries the US. On Sunday CVS announced that it would be purchasing Aetna a major health deal for 69 billion acquisition including a 77 billion debt.

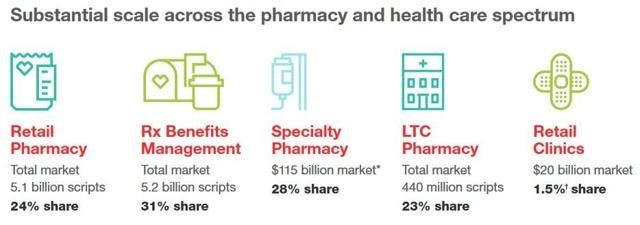

CVS and Aetna announced the deal in December 2017 and. CVS and Aetna assert they are motivated by a desire to improve services for consumers and that the merger will lower health care costs and improve outcomes. CVS also owns Caremark one of the three largest pharmacy benefit managers PBMs which negotiate drug discounts on.

In a conference call with analysts on Monday Merlo said that rising health care costs are a. The news of the CVS-Aetna merger paves the way for a potential to cut US. CVS rocked the healthcare industry last week when it bought Aetna for 69 billion merging health insurance services with retail offerings.

CEO Larry Merlo has outlined CVS vision for new stores that will include added health services. On September 4 2019 the federal judge issued his final ruling approving the proposed settlement of the federal challenge to the merger. 4 ways CVS-Aetna merger could change your health care All eyes on drug costs.

The CVS-Aetna merger has been one of the longest mergers in healthcare history. Healthcare costs for consumers and to turn more of its locations into front-line clinics for basic medical services and patient monitoring. The Implications of the Impending CVS and Aetna Merger.

The Department of Justice recently approved a 69 billion merger between retail pharmacy giant CVS Health and health insurer Aetna. CVS has gained the US governments approval to buy Aetna. The CVS-Aetna merger was a horizontal and a vertical merger.

While the Aetna merger played a role in rising revenues by 125 for CVS Health in the last quarter of 2018 it also hampered some crucial metrics. Many industry experts have postulated however that financial gain is at the heart of the deal. If approved by antitrust regulators the purchase of Aetna Healthcare provider this would become the largest deal in history.

As a major pharmacy benefits manager with nearly 90 million. CVS shareholders approve Aetna acquisition CVS Health and Aetna shareholders have approved a merger between the two health-care giants bringing them one step closer to finalizing a deal that could.

Judge Threatens To Delay Or Even Spike 70m Cvs Aetna Merger Massdevice

Judge Threatens To Delay Or Even Spike 70m Cvs Aetna Merger Massdevice

Cvs Aetna Merger Consumers Are Open Receiving Primary Care At Cvs Clinic

Cvs Aetna Merger Consumers Are Open Receiving Primary Care At Cvs Clinic

Cvs Aetna Merger What Does It Mean For Patients Amazon Health Services Houston Dallas Tx

Cvs Aetna Merger Could Mean Opportunity For Pharmacists Pharmacy Today

Cvs Aetna Merger Could Mean Opportunity For Pharmacists Pharmacy Today

At T Warner Bros Merger Gives High Hopes For Cvs Aetna Deal Healthcare Weekly

At T Warner Bros Merger Gives High Hopes For Cvs Aetna Deal Healthcare Weekly

Cvs Aetna Merger Future Healthcare Business Models Fletcher Csi Competitive Intelligence

Cvs Aetna Merger Future Healthcare Business Models Fletcher Csi Competitive Intelligence

Ahf Ahf Thanks Judge For Putting Brakes On Cvs Aetna Merger

Ahf Ahf Thanks Judge For Putting Brakes On Cvs Aetna Merger

What The 69 Billion Cvs Aetna Merger Means For Health Retail And Amazon

Ahf Cvs Aetna Merger Judge Allows Ahf To Propose Witnesses

Ahf Cvs Aetna Merger Judge Allows Ahf To Propose Witnesses

What Would A Cvs Aetna Merger Mean For Medicare Kff

What Would A Cvs Aetna Merger Mean For Medicare Kff

A Health Consumer Lens On Cvs Aetna Merger By Jane Sarasohn Kahn Tincture

A Health Consumer Lens On Cvs Aetna Merger By Jane Sarasohn Kahn Tincture

A Merger Between Cvs Health And Aetna Could Be What The Doctor Ordered The Economist

A Merger Between Cvs Health And Aetna Could Be What The Doctor Ordered The Economist

Furloughed Ideas Part Ii Cvs Health Corp Aetna Nyse Cvs Seeking Alpha

Furloughed Ideas Part Ii Cvs Health Corp Aetna Nyse Cvs Seeking Alpha

California Insurance Commissioner Asks Doj To Block Cvs Aetna Merger California Broker Magazine

Comments

Post a Comment