Entri yang Diunggulkan

- Get link

- X

- Other Apps

Once you reach this limit youll pay nothing for covered services. Medicare Advantage plans are run by private insurers.

Medicare 101 What S The Difference Between Original Medicare And Medicare Advantage Health Enews

Medicare 101 What S The Difference Between Original Medicare And Medicare Advantage Health Enews

Medicare Advantage Plans sometimes called Part C or MA Plans are offered by Medicare-approved private companies that must follow rules set by Medicare.

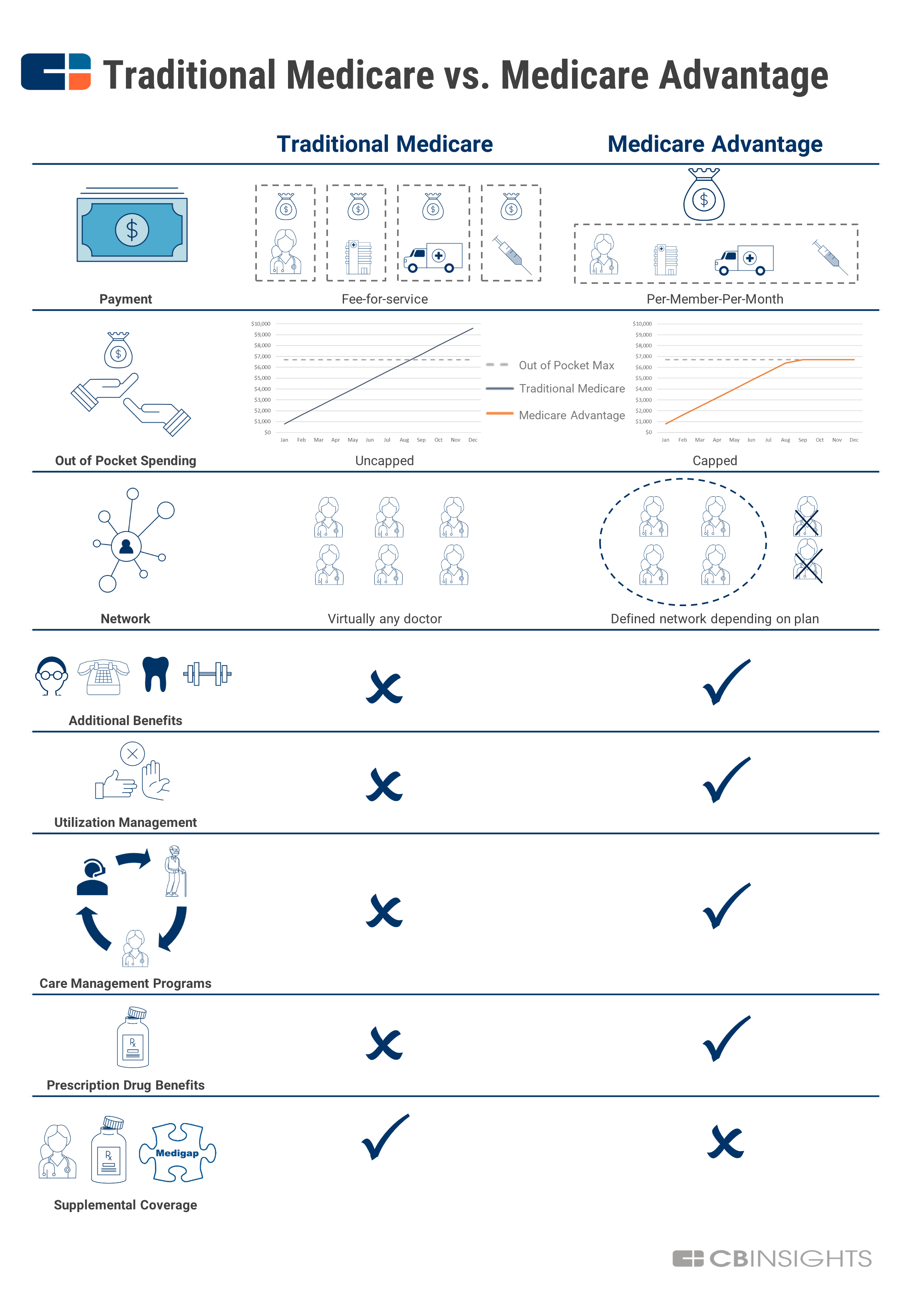

What to look for in a medicare advantage plan. Understand the quality of service that is provided to you. Medicare Advantage Plans cant charge more than Original Medicare for certain services like chemotherapy dialysis and skilled nursing facility care. The government pays Medicare Advantage plans a fixed monthly fee to provide services to each Medicare beneficiary under their care.

Instead look for a Medicare Advantage plan with drug coverage. Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage plans are run by private insurers unlike Original Medicare which the federal government operates although.

Having the added support of friendly trustworthy and knowledgeable representatives is the other part. Heres what to do when choosing a Medicare Advantage plan. Knowing that youll have the quality medical care you need is only part of the equation.

The government pays Medicare Advantage plans a fixed monthly fee to provide services to each Medicare beneficiary under their care. If youre looking for a Medicare Advantage plan whether its your first time enrolling in Medicare or youre participating in Medicares Annual Election Period here are six things you need to consider before buying in a Medicare Advantage plan. The plans often look attractive because they offer the same basic coverage as original Medicare plus some additional benefits and services that Original Medicare doesnt offer.

But if you are considering switching from Original Medicare to a Medicare Advantage plan you need to know what to look for. The plans often look attractive because they offer the same basic coverage as original Medicare plus some additional benefits and services that Original Medicare doesnt offer. Medicare Advantage plans have an annual out-of-pocket spending cap meaning the plan will pay the full cost for health services and supplies once you reach this limit.

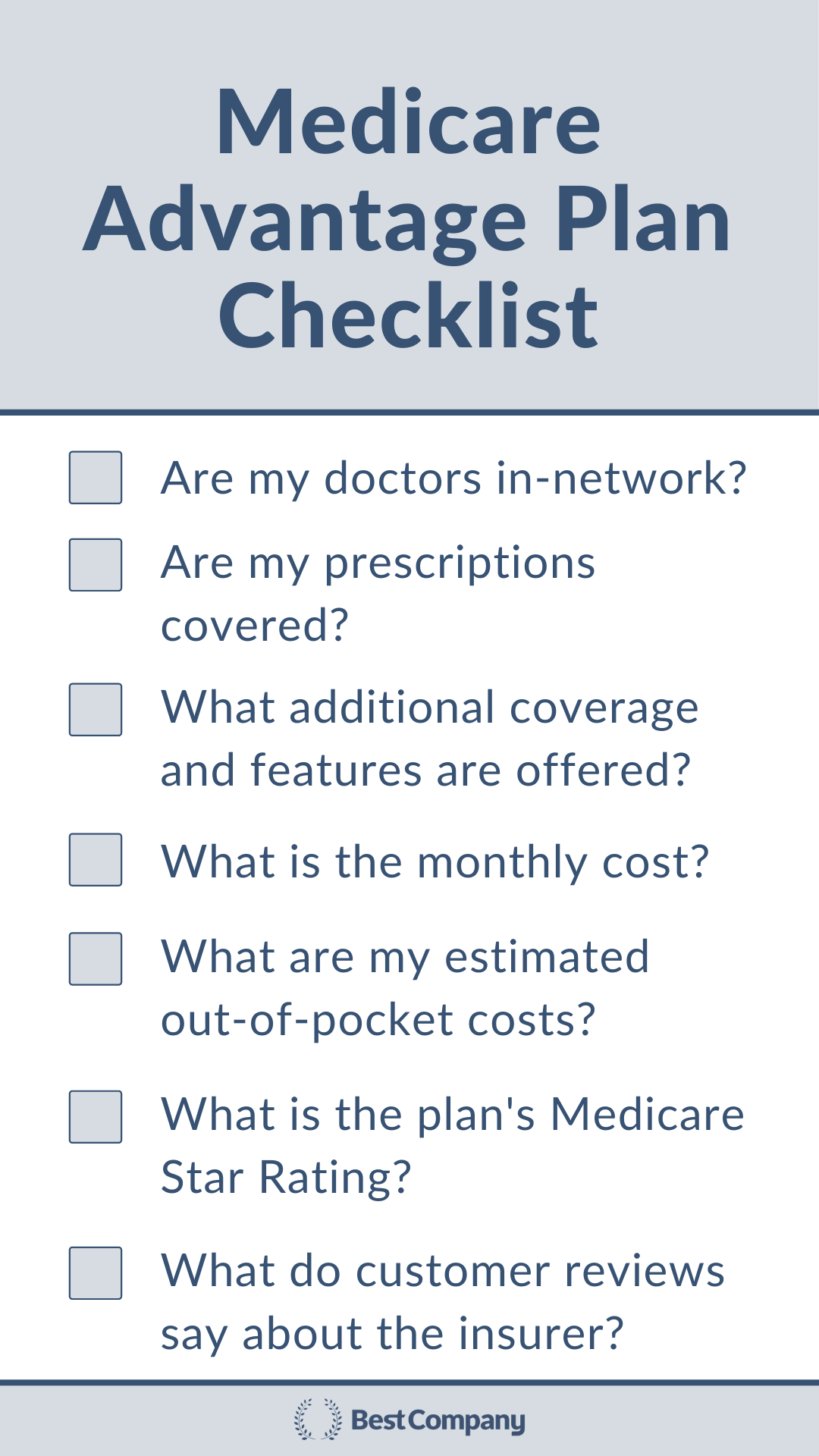

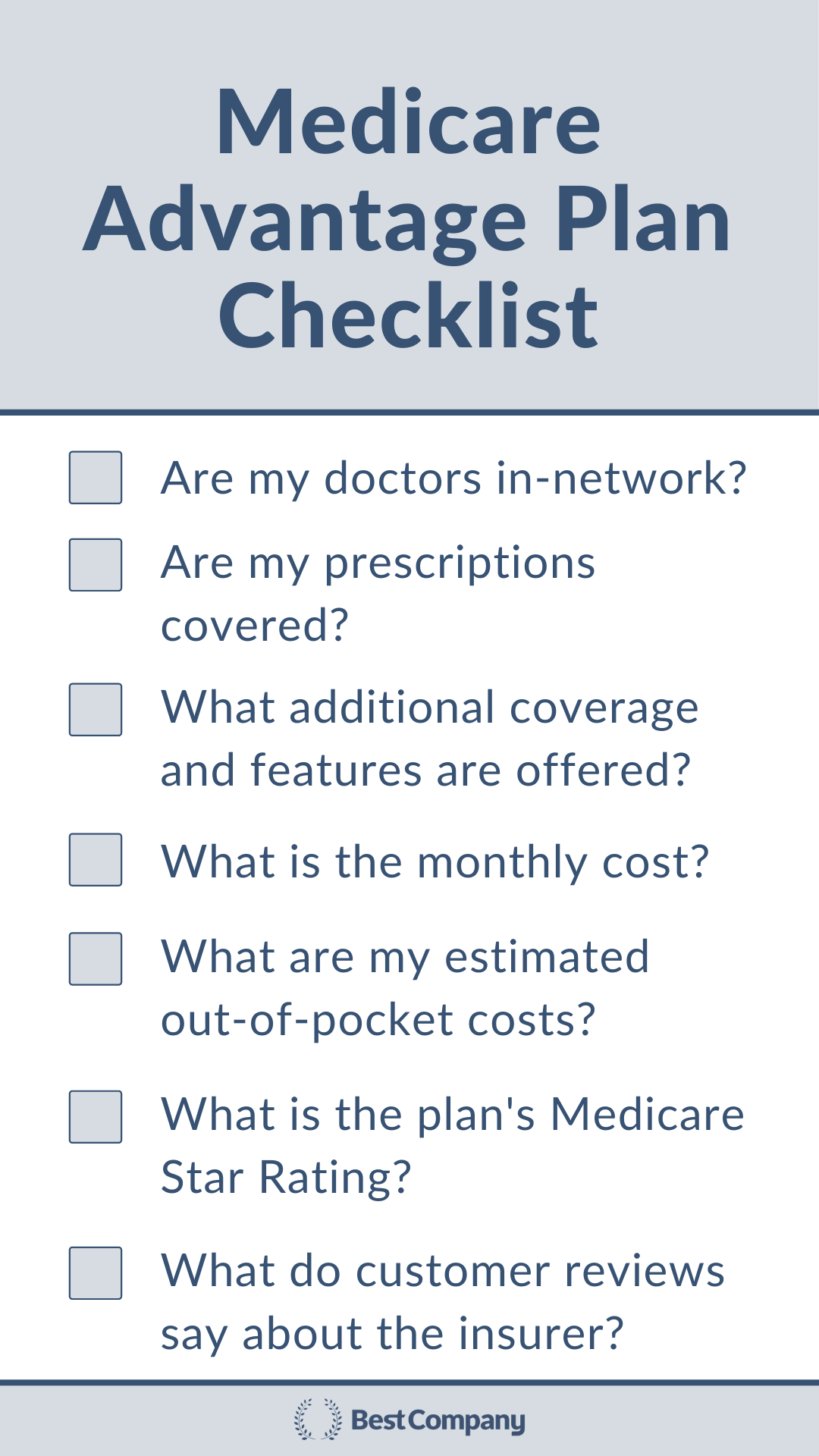

We recommend selecting a plan with 35 stars or more. Provider networks can change each year and even mid-year. What to look for when choosing a Medicare Advantage plan.

Supplemental coverage in Medicare Advantage. As Medicare premiums rise a Medicare Advantage plan can seem like an attractive option. Most Medicare Advantage Plans include drug coverage Part D.

For example if you have a health emergency and incur a lot of medical expenses theres a maximum youll pay before youre fully covered for the rest of that year. As Medicare premiums rise a Medicare Advantage plan can seem like an attractive option. The stars rate things such as customer satisfaction and the quality of care the plan delivers.

Medicare Advantage plans do have a cap on out-of-pocket costs while Original. And many Medicare Advantage plans offer vision hearing and dental. The plans often look attractive because they offer the same basic coverage as original Medicare plus some additional benefits and services that Original Medicare doesnt offer.

Medicare Advantage offers different plan types for your personal situation. Look at what doctors and hospitals are in the plans network. You cant use and cant be sold a Medigap policy if youre in a Medicare Advantage Plan.

While Medicare Advantage plans usually have lower premiums than paying for Original Medicare plus a Medigap plan they can have higher deductibles and co-pays in certain circumstances so you need to take those into account when calculating the cost of each plan. Costs that fit your budget and needs a list of in-network providers that includes any doctor s that you would like to keep coverage. As Medicare premiums rise a Medicare Advantage plan can seem like an attractive option.

But if you are considering switching from Original Medicare to a Medicare Advantage plan you need to know what to look for. But if you are considering switching from Original Medicare to a Medicare Advantage plan you need to know what to look for. It may be more cost effective for you to join a Medicare Advantage Plan because your cost sharing is lower or included.

Separate Part D plans average 3050 a month in 2021. For example if you have a chronic health condition an SNP Advantage plan can help with your medical costs. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services.

Here are a few things to look for in a Medicare Advantage plan. The government pays Medicare Advantage plans a fixed monthly fee to provide services to each Medicare beneficiary under their care.

Medicare Advantage Plans Greensboro North Carolina

Medicare Advantage Plans Greensboro North Carolina

What To Look For In A Medicare Advantage Plan Infographic

What To Look For In A Medicare Advantage Plan Infographic

6 Things To Look For In A Medicare Advantage Plan Bestcompany Com

6 Things To Look For In A Medicare Advantage Plan Bestcompany Com

Take A Look At The Benefits Of Medicare Advantage You Only Have Until December 7 To Enroll Call Us To Set Up An Medicare Advantage Medicare Retirement Money

Take A Look At The Benefits Of Medicare Advantage You Only Have Until December 7 To Enroll Call Us To Set Up An Medicare Advantage Medicare Retirement Money

How To Choose The Best Medicare Advantage Plan In 2021

How To Choose The Best Medicare Advantage Plan In 2021

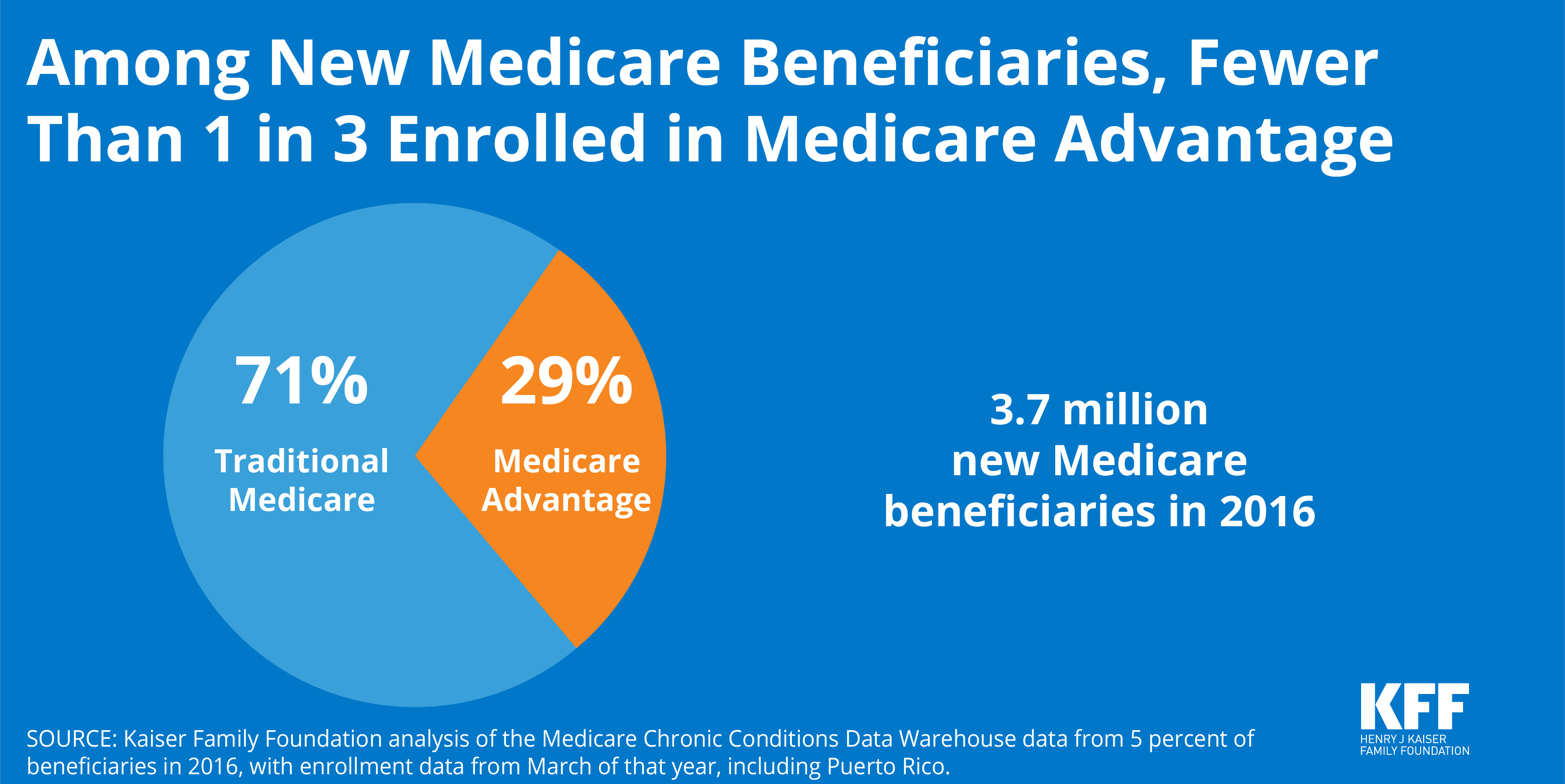

What Percent Of New Medicare Beneficiaries Are Enrolling In Medicare Advantage Kff

What Percent Of New Medicare Beneficiaries Are Enrolling In Medicare Advantage Kff

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Best Medicare Advantage Plans 2021

Best Medicare Advantage Plans 2021

What To Look For In A Medicare Advantage Plan Infographic

What To Look For In A Medicare Advantage Plan Infographic

Best Medicare Advantage Plans For 2021 Medicarefaq

Best Medicare Advantage Plans For 2021 Medicarefaq

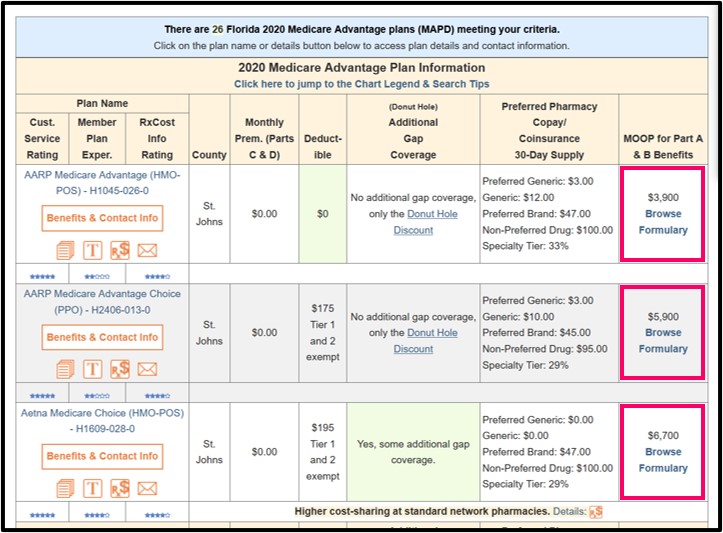

What Is My Medicare Advantage Plan S Maximum Out Of Pocket Limit Moop

What Is My Medicare Advantage Plan S Maximum Out Of Pocket Limit Moop

What To Look For When Choosing A Medicare Advantage Plan Strohschein Law Group

What To Look For When Choosing A Medicare Advantage Plan Strohschein Law Group

Comments

Post a Comment