Entri yang Diunggulkan

- Get link

- X

- Other Apps

But as of 2019 there is no longer a penalty for non-compliance with the individual mandate. Youll be charged a fee when you file your 2019 state taxes.

However there are several states and jurisdictions that still have a penalty for those who do not have health insurance.

/how-could-trump-change-health-care-in-america-495a19a0a11a48e2ad49deac0b279940.png)

Is there still a mandate for health insurance. The government regulates the insurers and operates a risk equalization mechanism to subsidize insurers that insure relatively more. Some states have their own individual health insurance mandate requiring you to have qualifying health coverage or pay a fee with your state taxes for the 2019 plan year. There is no federal penalty for not having health insurance since 2019 however certain states and jurisdictions have enacted their own health insurance mandates.

Is health coverage still required. This means that you will no longer have to pay a fine to the federal government if you choose to go without health insurance. However 5 states and the District of Columbia have an individual mandate at the state level.

The individual mandate itself is still in effect but there is no longer an enforcement mechanism so its essentially irrelevant. As of 2019 the Trump administration enacted a new mandate that removed the federal penalty for not having health insurance. Although the fee for not having health insurance has been reduced to 0 on a federal level since 2019 some states still have an individual mandate.

The rest of the Affordable Care Act and its many patient protections remain in effect. Yes the Obamacare is still the law of the land however there is no more penalty for not having health insurance. See below for information about exemptions for the individual mandate for 2018 and earlier.

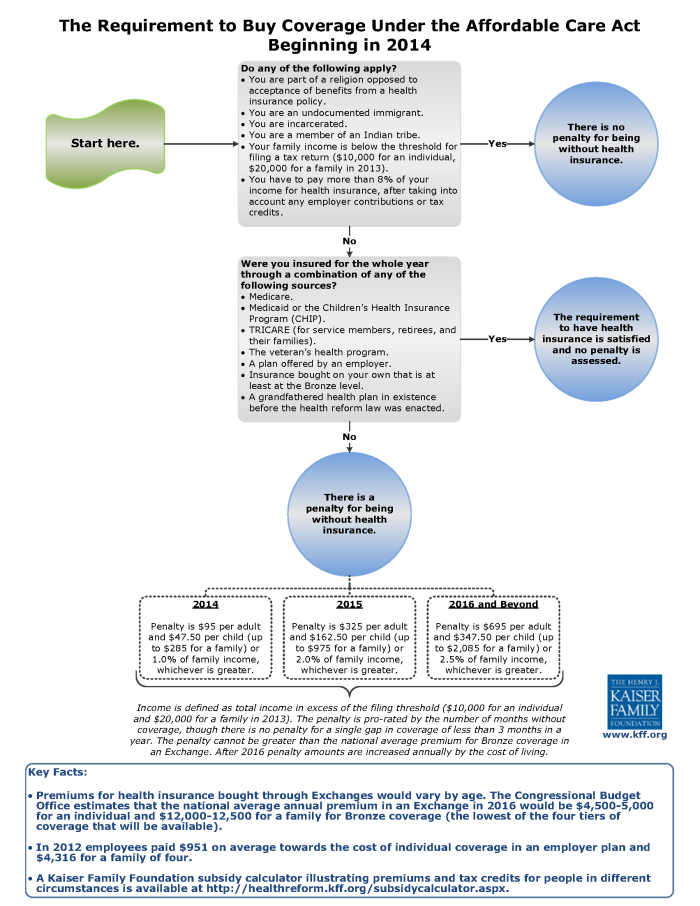

From 2014 through 2018 there was a penalty assessed by the IRS on people who didnt maintain coverage and who werent eligible for an exemption. Vermont enacted a mandate that took effect in 2020 but there is no penalty for non-compliance. Health insurance coverage is no longer mandatory at the federal level as of January 1 2019.

The ACA had an individual mandate meaning all Americans had to have health insurance or pay a tax penalty. Maryland lawmakers also removed mandate penalty language from a 2019 bill before it passed. Learn more about the individual mandate for 2014-2018 on HealthCaregov and the IRS websites.

There is a penalty in New Jersey DC Massachusetts California and Rhode Island. So technically the law does still require most Americans to maintain health insurance coverage. This is due to legislation that was enacted in late 2017.

Since 2019 there is no penalty for not having ACA coverage so healthiest people with be enrolling in short-term plans that are cheaper and offer larger networks however these plans do not protect pre-existing conditions. Essentially having health insurance is still a requirement but there will be no requirement of documentation to prove you have health insurance or even a requirement to affirmatively state that. Massachusetts has led the way on keeping consumers covered on health insurance and part of that has been the individual mandate said Hannah Frigand an associate director of Health Care for All.

Here is a list of states where you have to buy health insurance for 2020. Some states still require you to have health insurance coverage to avoid a tax penalty. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption.

These penalties vary by state or jurisdiction a few of which will be discussed in further detail below. Starting with the 2019 coverage year for which you will file taxes in 2020 there is no longer a tax penalty or individual mandate for not having health insurance. The federal individual mandate penalty was eliminated at the end of 2018.

It eliminated the penalty as of 2019 but did not eliminate the actual individual mandate itself. The Netherlands has a health insurance mandate and allows for-profit companies to compete for minimum coverage insurance plans though there are also mutual insurers so use of a commercial for-profit insurer is not compulsory. As of 2019 the Obamacare Individual mandate which requires you to have health insurance no longer applies at the federal level.

As of January 1 2019 health insurance is no longer mandatory at the federal level. In the world of health insurance that means a requirement to have health coverage. But Republican lawmakers opposed the individual mandate ultimately challenging it in court.

You may have to pay a penalty for not having health insurance if you live in one of the following. The individual mandate has been suspended and only applies for 2018 and earlier. The federal tax penalty for not being enrolled in health insurance was eliminated in 2019 because of changes made by the Trump Administration.

However there are still some states that require residents to enroll in. You pay a penalty if you go without qualifying health coverage for a period of three months or more. Qualifying coverage includes work-based plans and any plan you buy through the health insurance marketplace.

The mandate went into effect in 2014 requiring almost all Americans to maintain health insurance coverage unless theyre eligible for an exemption.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

/how-could-trump-change-health-care-in-america-495a19a0a11a48e2ad49deac0b279940.png) Donald Trump S Health Care Policies

Donald Trump S Health Care Policies

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

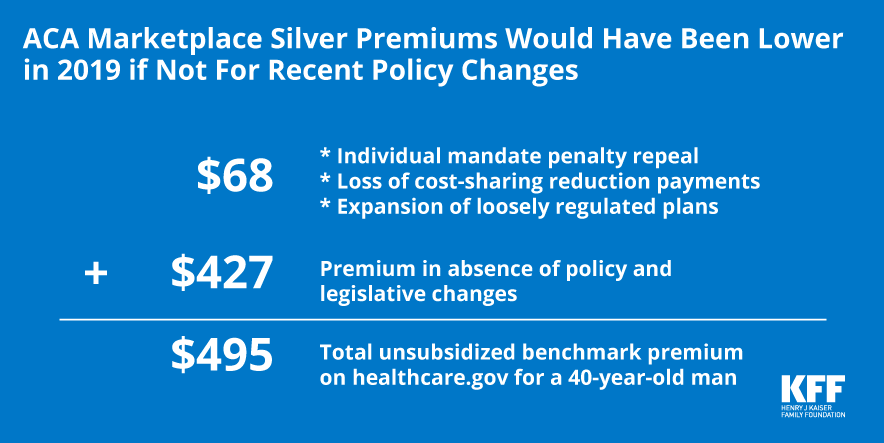

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

Will You Owe A Penalty Under Obamacare Healthinsurance Org

Will You Owe A Penalty Under Obamacare Healthinsurance Org

/obamacare-explained-1272f608281e4887969aa0a14b1bff1c.png) Obamacare Explained What You Need To Know Now

Obamacare Explained What You Need To Know Now

/health-insurance-66b8c34e2b9843d78005e00b1c7edc1a.jpg)

:max_bytes(150000):strip_icc()/obamacare-pros-and-cons-3306059-final-HL-75d611454d684942a27cf4463e4841a6.png)

Comments

Post a Comment